Velocity Community Credit Union

Velocity Community Credit Union is a progressive, full service financial institution that is passionate about helping its members. As a not-for-profit co-op, our dedicated employees can concentrate on providing superior service to our members while offering a full suite of products to meet all of their financial needs.

Why Join Velocity Community Credit Union?

- Because we’re a not-for-profit, financial cooperative.

- Because we’re locally owned by you, our members.

- Because we want to help you save money and succeed financially!

- Because “Community” is our middle name – As a community credit union, when you apply for membership or loans, decisions are made at our local branches by friendly staff providing superior service and competitive rates. We are a full-service, not-for-profit financial institution dedicated to serving our members. We support local charities and community events, because we live and work here – in your community!

As a community-chartered credit union, you can apply for membership if you:

- Live in Palm Beach County

- Work in Palm Beach County

- Worship in Palm Beach County

- Attend school in Palm Beach County

- Have family who are eligible for membership

Are you still unsure if you are eligible? Give us a call at (561) 775-2525 or (800) 872-4517. Our Branch Consultants will be happy to answer your questions.

How Do I Become a Member?

You can start online with our handy online application. In three easy steps, you can complete the requested information online. We will follow up with as soon as possible to complete your account. To get started, click here or stop by one of our local branches to speak with a Branch Consultant. We will ask to see identification when opening an account. Once you’ve opened a savings (share) account with us, you are officially a member/owner of the Credit Union!

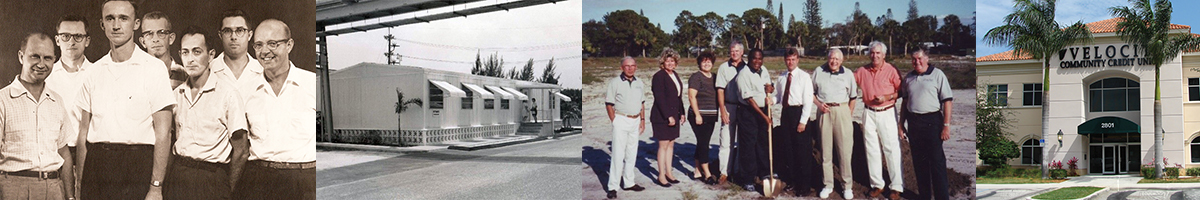

History

As Florida Aircraft Federal Credit Union, we received a Federal charter in 1958 to serve the financial needs of the employees and immediate family members of Pratt & Whitney Aircraft (a division of United Technologies Corporation). The philosophy of the “Founding Directors” was to promote thrift and provide loans at reasonable and competitive rates. As a not-for-profit financial institution, the Credit Union established a history of rewarding its membership with above average dividends on both share and share draft accounts, while treating all members equal regardless of their account balance.

As times have changed, so have we. Renamed Velocity Community Credit Union, we opened our doors to the entire community. Now everyone who lives, works, worships, or attends school in Palm Beach County, FL can become a member.

Safe & Secure at Velocity Community Credit Union

We Have Five Stars With Bauer Financial

BauerFinancial, Inc. has been analyzing and reporting on the financial condition of the nation’s banking industry since 1983. They are an independent company that rates banks and credit unions for fiscal responsibility and soundness. For more information, go to Bauer Financial’s Web Site.

How Are My Funds Insured at Velocity Community Credit Union?

As a federally chartered credit union, your funds at Velocity Community Credit Union are insured to at least $250,000 through NCUA’s National Credit Union Share Insurance Fund. Similar to the FDIC, the NCUSIF is in many ways the stronger fund. Credit unions have traditionally been less affected by the scandals – and consquent closures – of many other financial institutions, most notably the Savings and Loan Debacle of the late 1980’s.

For a great video about share insurance, visit the Credit Union National Association’s Consumer webpage. They also have links to other share insurance information and a credit union fact sheet packed with real numbers to show how secure your funds are at a credit union.

NCUA Resources

The NCUA has provided various useful resources to help educate members regarding the benefits of share insurance coverage afforded at federally insured credit unions. NCUA-insured shares are backed by the full faith and credit of the United States Government. NCUA protects members against losses should a federally insured credit union fail. No member has ever lost insured funds.

NCUA has created a website solely for consumers – www.mycreditunion.gov. Here you will find consumer specific information about credit unions such as:

- Consumer Assistance Center

- Consumer Privacy

- Credit Union Locator

- Fraud Information Center

- Share Insurance Fund