Credit Union Impersonation Scams Occurring In 2022

Security

April 07, 2022

As technology continues to improve, scammers are getting creative on the different ways they try to steal your information. There has been an increase in credit union impersonation scams, where a fraudster convinces a member that they are speaking with their financial institution. The member, then, shares their personal information with the scammer. The first thing to remember is that your credit union will never use insecure channels, like calling, emailing, or texting, to initiate a request for private account information. On the other hand, scammers have developed different strategies using these channels to get your personal information.

Channels

Phishing

Phishing emails are created to look like they are coming from a legitimate source like your credit union. The email may have the company logo or look like it was sent by a staff member. The email will ask you to share personal information or click on a link to supposedly take you to a secure location to submit your information. Velocity Community Credit Union will never ask for personal information such as account numbers, passwords, debit or credit card numbers, expiration dates, or personal identification numbers over an email.

Here are just a few ways to identify phishing emails:

- The message is sent from a public email domain like, ‘@gmail.com’.

- There are grammar mistakes throughout the email.

- There is a sense of urgency within the messaging so if you don’t react immediately something bad will happen. For example, your account will be locked.

SMishing

With credit union impersonation scams, imposters will use texting as a channel to steal your information as well. The SMS (Short Message Service) or cell phone texts will be labeled in a way to looks like it is coming from your financial institution but is a scammer. The messaging will add a sense of urgency, so you won’t think twice about replying.

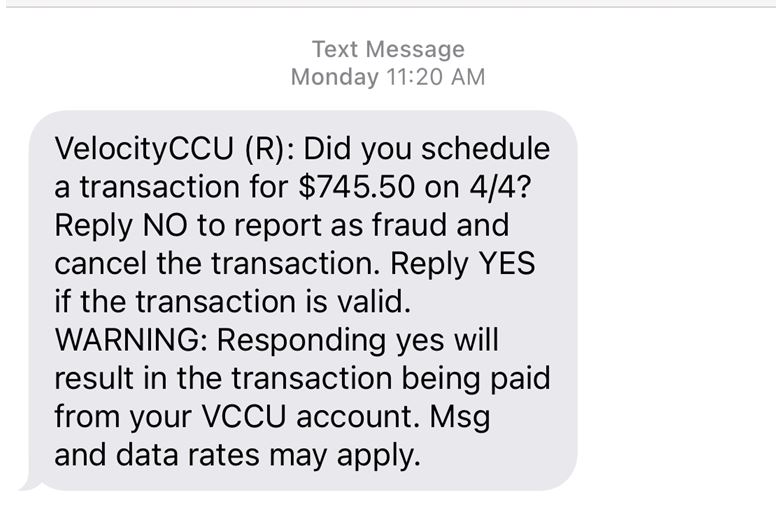

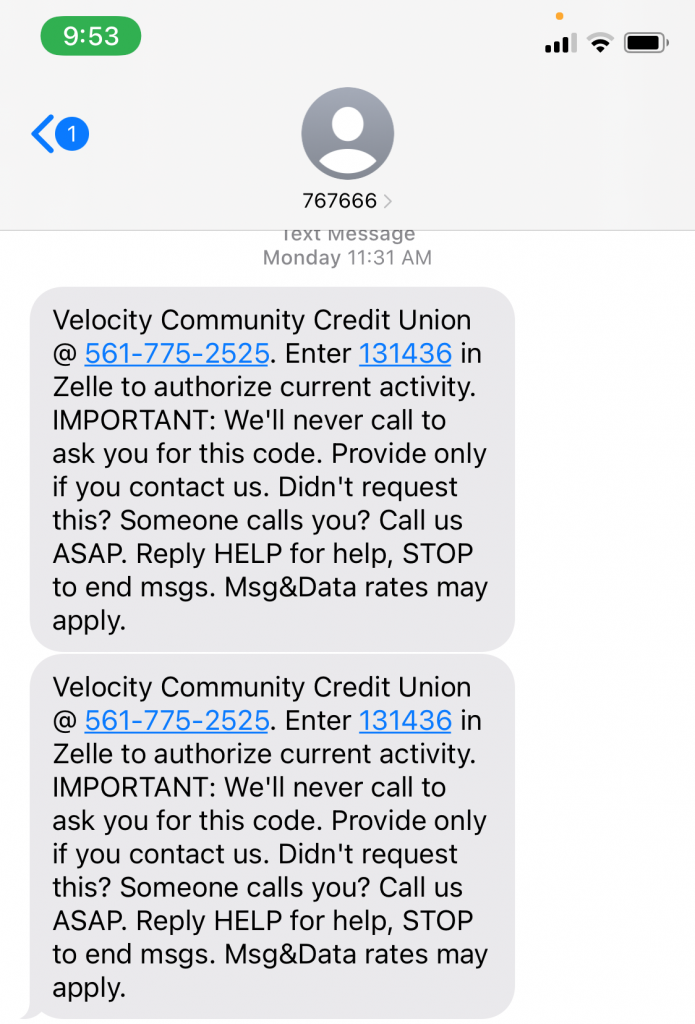

Here is an example of SMishing:

In this example, a “no” reply will prompt the fraudster to call and continue with their scam to get your information. Instead of replying, call your credit union through an independently sourced number.

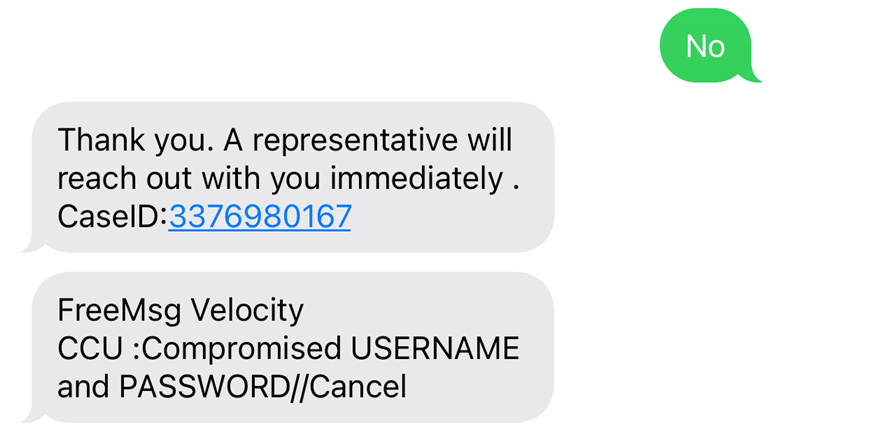

Below is an example of a legitimate text from Velocity Community Credit Union regarding a Zelle Payment:

Vishing

With Vishing, fraudsters call you over the phone and pretend to be a credit union staff member that needs personal information from you. A huge change in how easy it is to detect the scam is that you aren’t able to easily identify the call is a scam by the phone number now. Scammers are spoofing caller ID so it will say that the call is coming from your credit union.

Here is how to spot a vishing scam:

- The caller pushes a sense of urgency on the member. Scammers use fear and even threats to make the member afraid to question their legitimacy.

- The caller asks for your personal information. The scammer is looking to get personal information to break into your account. Your financial institution will never ask for personal information over the phone.

If you ever get a call, text, or email from your financial institution and you are questioning the legitimacy, make sure to reach out directly. Report the scam to the Federal Trade Commission online or by the phone at 1-877-382-4357.

Credit union impersonation scams are common. Make sure you know what scams are out there and are taking precautions to protect yourself. Head to our Stay Secure page to learn more about different scams we are seeing pop up!

Source: CreditUnion.gov